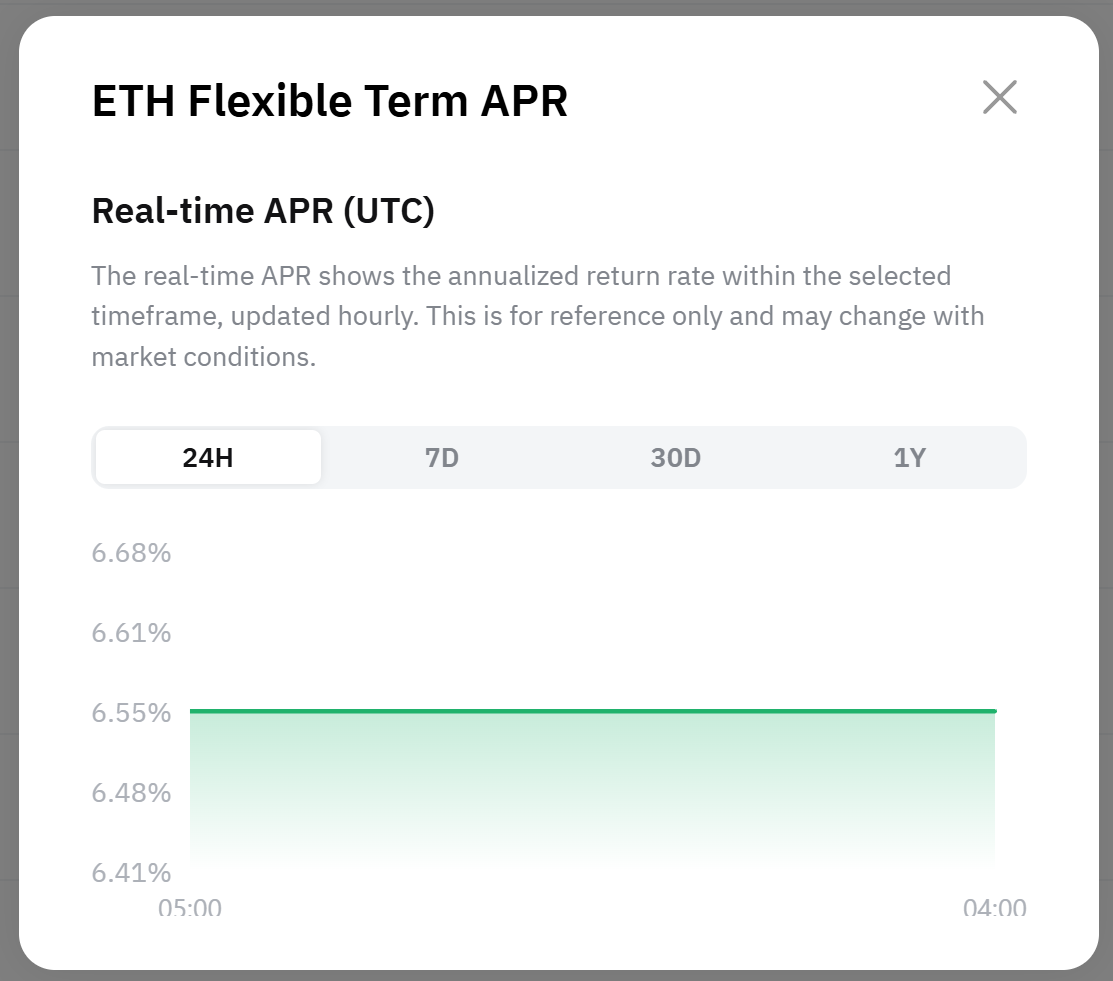

What is the real-time APR?

The real-time APR displayed in Flexible Term products is a floating, annualized return rate based on the selected timeframe, updated hourly. It is for reference only and may fluctuate due to market conditions, the loan-to-pool ratio and other factors.

Please note that the APR is an estimate and may not reflect the exact return you'll receive. You can view the APR over the past 24 hours, 7 days, 30 days or 1 year on the chart.

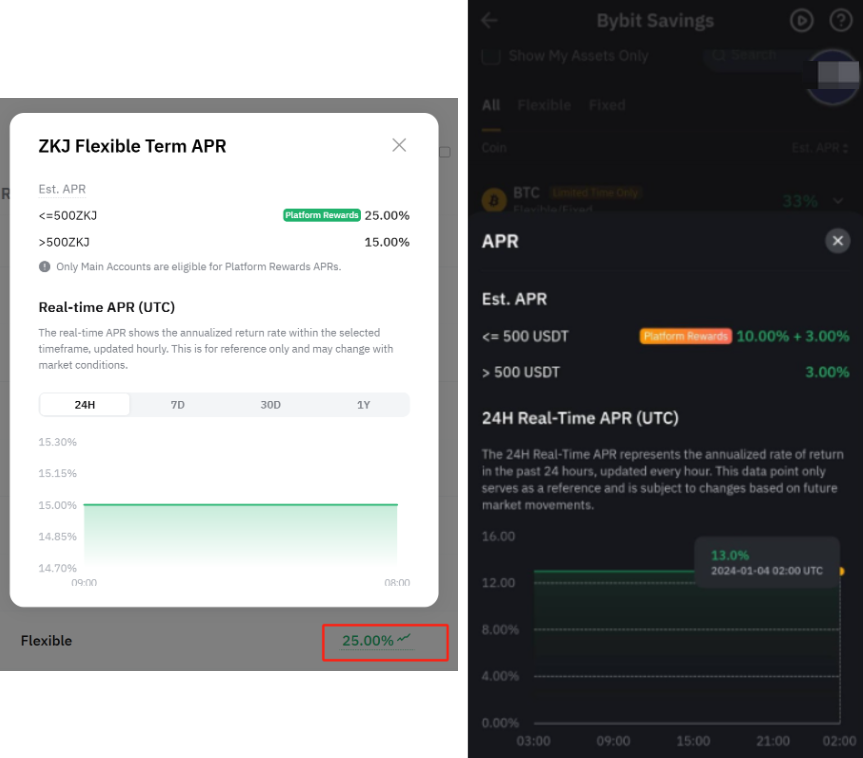

What is the tiered APR in Flexible Term products?

Flexible Term products offer tiered interest rates based on the amount of assets you invest. The APR varies by tier and may change depending on market conditions. On the Bybit website, a tiered APR is indicated by a dotted underline, while in the Bybit App, it appears in orange.

Please note that your yield may include both a basic APR and platform rewards. The basic APR is floating and calculated hourly.

Will I be notified of APR adjustments for Flexible Term products during the investment period?

No, users currently do not receive notifications for APR adjustments. The APR may change at any time based on market conditions.

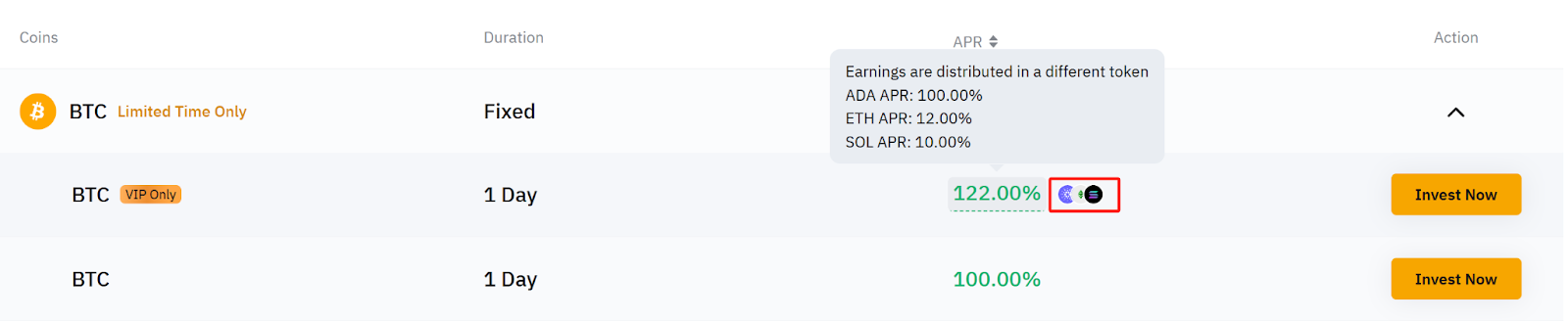

Why are there multiple coin icons under the APR for some plans?

Some Fixed Term plans allow you to earn yields in one or more coins different from the one you invested in, helping you diversify your rewards without any extra effort. For example, by investing in BTC, you may earn rewards in BTC, ETH and USDT.

-

If you see only a number under the APR, it means your yield will be distributed in the same asset you invested.

-

If there are multiple coin icons next to the number, your yield will be split across those coins, and the displayed APR reflects the total combined rate. Final earnings are calculated based on the average Spot price in the 30 minutes before your order is placed, so actual returns may differ slightly from the estimate. You can check the order history to view your yield after placing your order.

Please note that this feature is not currently available for Flexible Term products.

What is the effective investment amount?

The effective investment amount refers to the amount of assets that currently contribute to yield calculation.

Let's use the Flexible Term product as an example. Newly invested assets become effective starting the next hour. For instance, if you invest 20,000 USDT at 10AM UTC on Jun 1, your effective investment amount will be updated to 20,000 USDT at 11AM UTC on the same day.

How is my daily yield calculated?

The yield calculation differs between Flexible Term and Fixed Term products. Let's break it down:

Flexible Term:

Your daily yield depends on the type and amount of assets invested. Yield begins accruing from the next full hour after your investment and is credited to your Funding Account at 12:30AM UTC the following day.

Calculation formula:

Hourly yield = Effective investment amount × APR ÷ 365 ÷ 24

Daily yield = Hourly yield × Number of investment hours

Example:

Alice invests 20,000 USDT on Jun 1 at 9:30AM UTC. The estimated APR for USDT is 9%.

-

Yield accrual start: 10AM UTC on Jun 1

-

If Alice doesn't redeem on the same day:

-

At 11AM UTC, her first hourly yield of 0.2054 USDT (20,000 × 9% ÷ 365 ÷ 24) is accrued.

-

By the end of the day (14 hours of investment), she earns a total of 2.8767 USDT, which will be credited to her Funding Account at 12:30AM UTC on Jun 2.

-

-

If Alice redeems 10,000 USDT at 3:30PM UTC, she will receive:

-

10,000 USDT in principal

-

1.0273 USDT in yield from 10AM to 3PM UTC (20,000 × 9% ÷ 365 ÷ 24 × 5)

-

The remaining 10,000 USDT will continue earning yield for the rest of the day, generating 0.9246 USDT (10,000 × 9% ÷ 365 ÷ 24 × 9), which will be credited to her Funding Account at 12:30AM UTC on Jun 2.

-

-

If Alice invests an additional 10,000 USDT on Jun 2 at 7:30AM UTC:

-

Yield from this new amount starts accruing at 8AM UTC and will be credited at 12:30AM UTC on Jun 3.

-

Fixed Term:

With Fixed Term products, both the APR and investment duration are locked in at the time of purchase. Yield starts accruing on the next day after investment, and both the principal and yield are automatically credited to your Funding Account when the product matures.

Calculation formula:

Total Yield = Effective investment amount × APR ÷ 365 × Investment days

Example

Alice invests 20,000 USDT on Jun 1 for a 7-day term at an APR of 9%.

-

Yield starts accruing from 12AM UTC on Jun 2.

-

At 12:30AM on Jun 9, she will receive:

-

20,000 USDT in principal

-

34.52 USDT in yield (20,000 × 9% ÷ 365 × 7)

-

Note: There may be a delay of up to 12 hours in yield distribution for both Flexible and Fixed Term products due to differences in timing between yield calculation and loan interest collection.

How does the tiered APR affect my yield?

The tiered APR applies only to Flexible Term products. While the formula for calculating daily yield remains the same, the APR used may vary depending on the amount of assets you've invested.

Example

Assume the following APR tiers for USDT:

|

Tier |

Investment amount |

APR |

|

1 |

≤ 500 USDT |

12.00% |

|

2 |

500 - 1,000 USDT |

0.70% |

|

3 |

> 1,000 USDT |

0.28% |

Let's say Alice invests 10,000 USDT at 2PM UTC on Jul 3. Her hourly yield calculation begins at 3PM UTC.

If Alice doesn't redeem her assets on Jul 3, she'll receive 0.0911 USDT at 12:30AM UTC on Jul 4, automatically credited to her Funding Account. This amount is based on 9 hours of yield and calculated as follows:

[(500 × 12%) + (500 × 0.7%) + (9,000 × 0.28%)] ÷ 365 ÷ 24 × 9 = 0.0911 USDT

When will my yield be calculated and credited to my account?

Flexible Term:

Yield starts accruing from the next full hour after your investment and is calculated hourly. The total accrued yield is credited daily to your Funding Account at 12:30AM UTC on the following day (T+1). It may take up to 5 minutes for the yield to appear in your account.

Please note that no yield is generated on redeemed assets, and you won't earn yield for the hour in which the redemption takes place.

Fixed Term:

Yield begins accruing on the next day (T+1) after your investment. The total yield will be credited to your Funding Account at 12:30AM UTC on the yield distribution date.

Will my yield be compounded?

Flexible Term:

You can automatically reinvest the yield you receive by enabling the Auto-Earn option. In this case, it won't be treated as a new order — your yield will be combined with your existing invested assets to generate additional yield. Please note that the total investment amount must not exceed the maximum limit.

Fixed Term:

Compounding is not currently supported for Fixed Term products. Since the yield isn't automatically reinvested, you'll need to manually make a new investment to continue earning yield.

When can I redeem the assets I've invested?

Flexible Term:

You can redeem your assets at any time. Once redeemed, your principal and any accrued yield will be immediately credited to your Funding Account. To redeem, go to Assets → Earn → Easy Earn → Flexible Term.

You can also use the Batch Redeem button on the Easy Earn page to redeem up to 10 assets at once. For more details, please refer to How to Get Started With Easy Earn.

Fixed Term:

Assets cannot be redeemed until the product reaches maturity. Your principal and yield will be distributed to your Funding Account on the yield distribution date. Some products may support early redemption — please refer to the product page for details.

Can I partially redeem my assets?

Flexible Term:

Yes. The redeemed principal and any yield accrued up to the time of redemption will be distributed immediately.

Please note that if the remaining investment amount falls below the minimum limit after partial redemption, the remaining assets will no longer generate yield.

Fixed Term:

No. You cannot redeem your assets until the product reaches maturity.

Can I stake more assets if the plan I initially invested in is sold out?

No. You can't stake additional assets once the plan is sold out. However, the plan may become available again if other users redeem their assets, opening up more capacity for new investments.

Will I continue to receive yield if the plan I've invested in is sold out?

Yes. You'll continue to earn yields based on your investment — until the product matures for Fixed Term products, or until you redeem for Flexible Term products — even if the plan is sold out.

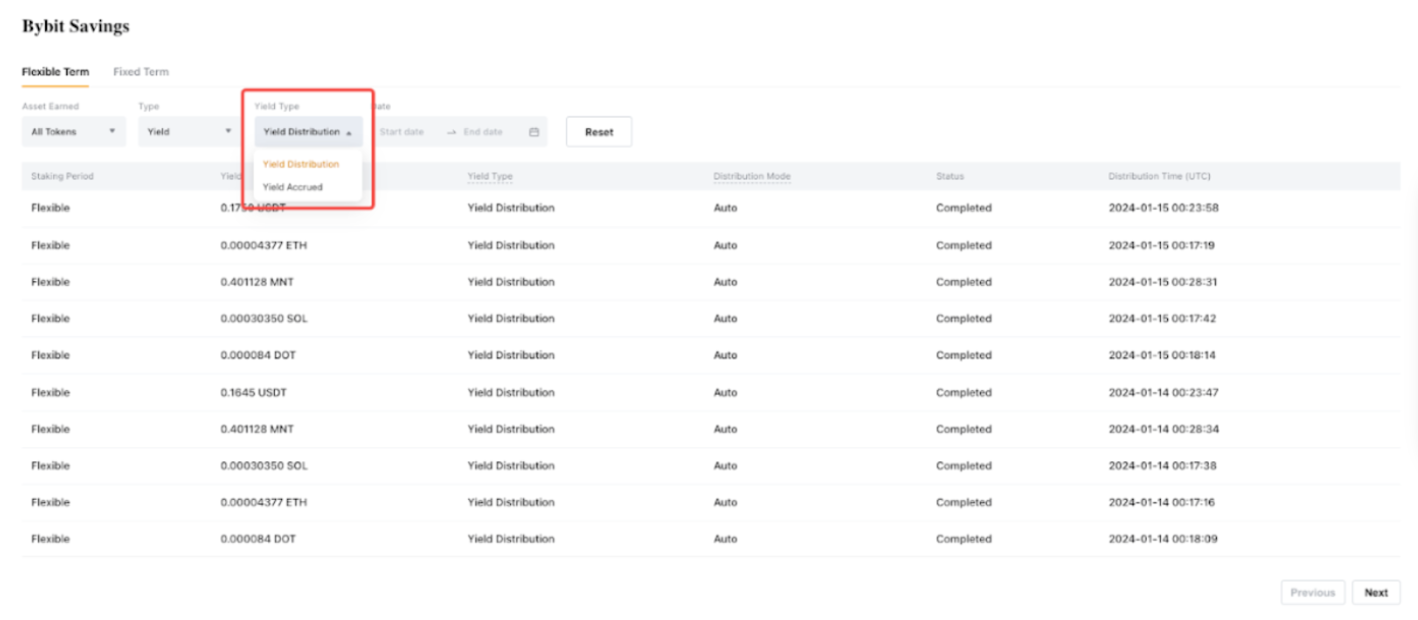

Where can I check my investment and yield records?

You can view detailed investment and redemption records in your Funding Account by going to Orders → Earn → Easy Earn. To view your yield information, change the Type filter to Yield to see both Yield Distribution and Yield Accrued records.

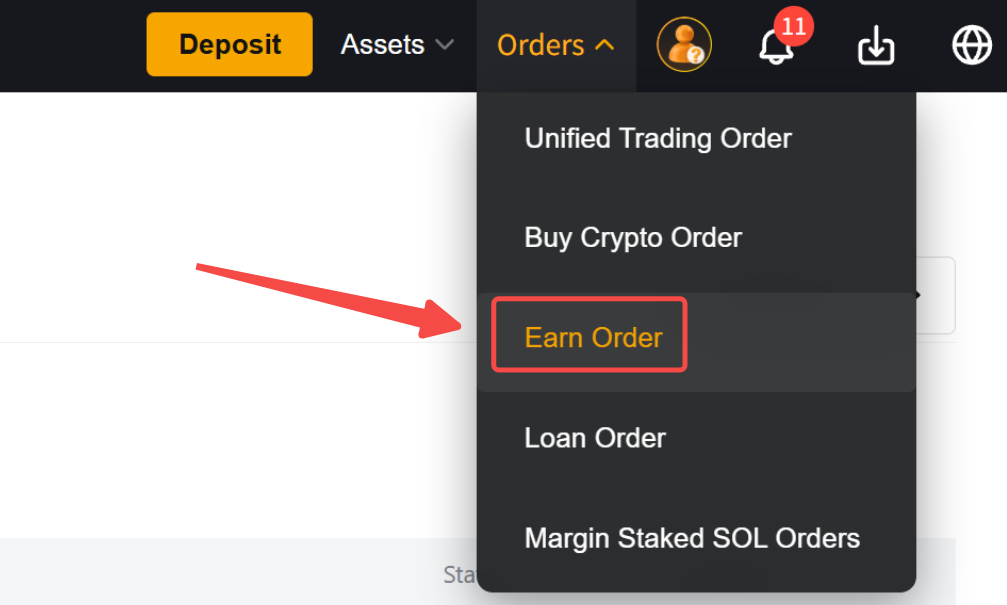

Alternatively, go to Orders in the navigation bar and click Earn Order.

For more details, please refer to How to Get Started With Easy Earn.