In the Unified Trading Account, "In Use" represents the portion of your margin currently reserved across different products. It ensures that your Available Balance accurately reflects all ongoing trading activities and risks.

Since margin is handled differently under each margin mode, the definition of In Use varies by mode.

-

Isolated Margin mode: You must hold the settlement asset to place Spot or Derivatives orders. In Use is calculated per asset (per settlement currency) and includes the order cost reserved in the settlement asset for your open orders. For more details on order cost calculation, check here.

-

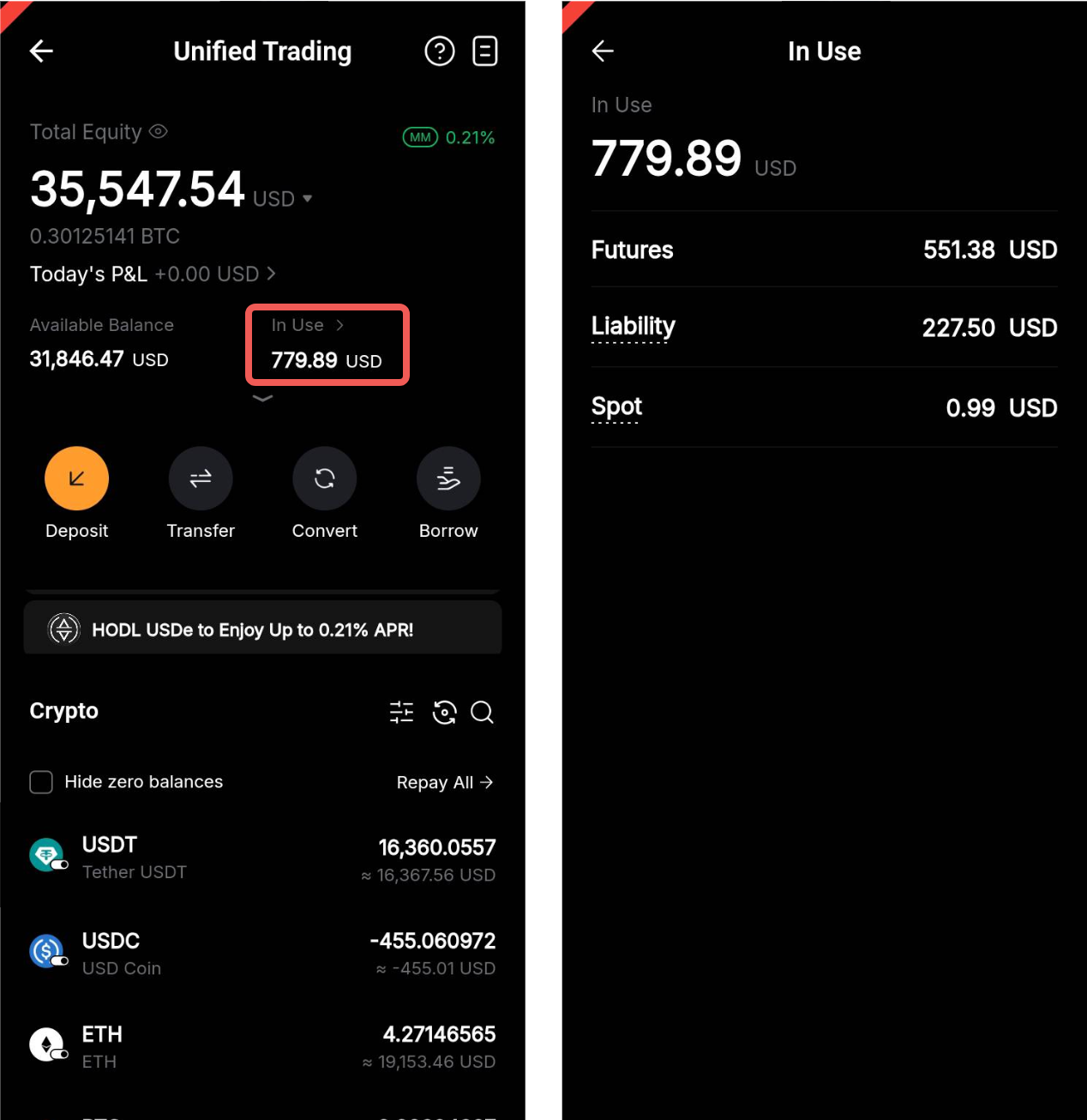

Cross Margin / Portfolio Margin mode: The margin balance determines how much can be used to maintain account risk and place orders. On the Bybit App, you can now view Account In Use, which shows the portion of your margin balance currently occupied as initial margin.

The sections below explain how Asset In Use is calculated for each product type in Cross Margin (or Portfolio Margin) mode.

1. Spot In Use

Definition: Includes the haircut loss incurred on your Spot orders.

Each margin asset has a collateral value ratio.

-

If the ratio is below 100% (e.g., 25%), only that portion of the asset's value can be used as collateral.

-

The reduction is called a haircut loss.

When you use a higher-value collateral asset to buy a lower-value asset, a haircut is reserved upfront. This prevents sudden jumps in your MMR (Maintenance Margin Rate) once the order is filled.

Formula:

Haircut = Max((Sell Collateral – Buy Collateral), 0) × Order Price × Order Size

Example:

-

Trader A uses USDT (collateral value ratio = 1) to buy 1 BTC (collateral value ratio = 0.98).

-

BTC price = 100,000 USDT.

Therefore,

-

Haircut = Max((1 − 0.98), 0) × 100,000 × 1 = 2,000 USD

-

Spot In Use = 2,000 USD

2. Liabilities In Use

Definition: Represents the initial margin required for assets borrowed in Spot Margin Trading.

Formula:

Initial Margin (for borrowed assets) = Sum(Liabilities × Index Price × Spot Initial Margin Rate)

Spot Initial Margin Rate = 1 ÷ Leverage

Example:

Trader A has 10,000 USDT in liabilities, the USDT index price is 1, and the leverage used is 5x.

Therefore,

-

Initial margin for borrowed assets = 10,000 × 1 × (1 ÷ 5) = 2,000 USD

-

Liabilities In Use = 2,000 USD

3. Futures In Use

Definition: Includes the initial margin required for Perpetual and Expiry positions and orders.

Formula:

Position IM = (Position Value ÷ Leverage) + Estimated Fee to Close

Active Order IM = (Order Value ÷ Leverage) + Estimated Fee to Open + Estimated Fee to Close

-

Position Value (USDT & USDC Contracts) = Position Size × Mark Price

-

Position Value (Inverse Contracts) = Position Size ÷ Mark Price

-

Order Value (USDT & USDC Contracts) = Order Size × Order Price

-

Order Value (Inverse Contracts) = Order Size ÷ Order Price

Example:

Assume the mark price of BTC is 100,000 USDT.

-

Trader A holds a 2 BTC position on BTCUSDT with 10x leverage.

-

Trader A also places an order of 2 ETH on ETHUSDT at an order price of 4,000 USDT, also with 10x leverage.

-

The USDT index price = 1, and fees are ignored.

Therefore,

-

Position IM = 2 × 100,000 ÷ 10 = 20,000 USD

-

Order IM = 2 × 4,000 ÷ 10 = 800 USD

-

Total IM = 20,800 USD

-

Futures In Use = 20,800 USD

4. Options In Use

Definition: Refers to the initial margin required for:

-

Holding short Options positions

-

Placing Options orders