Apa itu LP CLMM?

LP CLMM adalah fitur di Bybit Alpha yang memungkinkan penyedia likuiditas (LP) untuk berpartisipasi dalam pool Market Maker Likuiditas Terkonsentrasi (CLMM) dan mengalokasikan modal mereka dalam rentang harga tertentu, daripada mendistribusikannya secara merata di seluruh spektrum harga seperti pada sistem Automated Market Maker (AMM) tradisional. Pendekatan bertarget ini meningkatkan efisiensi modal dan membantu memaksimalkan potensi imbal hasil.

Apa itu penyedia likuiditas (LP)?

Penyedia likuiditas (LP) adalah individu atau entitas yang menyediakan aset mata uang kripto ke pool likuiditas di bursa terdesentralisasi (DEX) atau protokol keuangan terdesentralisasi (DeFi) lainnya. Sebagai imbalan atas penyediaan likuiditas, LP biasanya mendapatkan biaya trading atau hadiah lainnya.

Bagaimana cara kerja CLMM?

Dalam sistem CLMM, LP memilih rentang harga tertentu untuk disediakan likuiditas. Ketika harga pasar pasangan trading tetap dalam rentang tersebut, likuiditasnya akan digunakan secara aktif untuk memfasilitasi trading, sehingga memungkinkan mereka untuk mendapatkan biaya. Jika harga bergerak di luar rentang yang dipilih, likuiditasnya akan menjadi tidak aktif, dan mereka akan berhenti mendapatkan penghasilan dari biaya sampai harga bergerak kembali dalam rentang tersebut.

Apa saja keunggulan CLMM?

Keuntungan utama CLMM adalah kemampuannya untuk menargetkan rentang harga aktif, yang menghasilkan efisiensi modal lebih besar dan membantu memaksimalkan imbal hasil.

Pada model AMM tradisional, likuiditas didistribusikan secara merata di seluruh rentang harga, sehingga sebagian besar tidak digunakan, terutama pada pool koin stabil di mana harga selalu relatif stabil.

Dengan CLMM, LP dapat memusatkan modal mereka dalam rentang harga yang lebih sempit di mana aktivitas trading lebih tinggi. Ini tidak hanya meningkatkan potensi pendapatan penghasilan dari biaya tetapi juga memberi LP lebih banyak kendali atas posisi mereka dan paparan terhadap kerugian tidak tetap.

Apa itu Total Nilai Terkunci (TVL)?

Total Nilai Terkunci (TVL) adalah total nilai aset yang saat ini disimpan dalam protokol atau platform DeFi tertentu. Dalam konteks pool likuiditas, TVL merepresentasikan total jumlah modal yang dipasok oleh LP.

Apakah ada risiko yang terkait dengan LP CLMM?

Ya. Semua aktivitas penghasil hasil memiliki risiko melekat, tidak terkecuali LP CLMM. Sebagai iterasi leverage dari model CPMM, LP CLMM menawarkan potensi imbal hasil yang lebih tinggi, tetapi juga memiliki paparan risiko lebih besar.

Rentang harga lebih sempit umumnya berarti risiko lebih tinggi. Jika harga pasangan trading bergerak di luar rentang yang Anda pilih, Anda akan berhenti mendapatkan penghasilan dari biaya, dan posisi Anda akan sepenuhnya dikonversi menjadi salah satu dari dua aset yang Anda suplai di awal.

Misalnya:

- Jika harga SOL/USDC turun di bawah rentang yang Anda pilih, Anda hanya akan memiliki SOL.

- Jika harga SOL/USDC naik di atas rentang yang Anda pilih, Anda hanya akan memiliki USDC.

Protokol apa yang didukung LP CLMM?

Saat ini, LP CLMM mendukung protokol berikut: Byreal, Raydium dan Orca.

Siapa yang dapat stake LP CLMM di Bybit Alpha?

LP CLMM tersedia bagi pengguna yang telah menyelesaikan Verifikasi Identitas Standar. Harap diperhatikan bahwa pengguna institusi dan pengguna dari negara atau region yang dibatasi tidak memenuhi syarat untuk fitur ini. Untuk mempelajari selengkapnya tentang Verifikasi Identitas, silakan lihat T&J - KYC Individual.

Jenis akun apa yang didukung LP CLMM?

Hanya aset dari Akun Trading Terpadu (UTA) yang didukung. Pastikan aset Anda berada di UTA sebelum staking. Saat penebusan, aset dan hadiah Anda juga akan dikreditkan kembali ke UTA. Untuk mempelajari selengkapnya tentang transfer antar jenis akun berbeda, silakan lihat artikel ini.

Apakah Akun Sekunder dan Akun Islam didukung?

Ya. Akun Sekunder dan Akun Islam didukung.

Token apa yang dapat saya stake di LP CLMM?

Saat ini, SOL, bbSOL, USDC, dan USDT didukung untuk staking di LP CLMM.

Jaringan apa yang didukung oleh LP CLMM?

Saat ini, LP CLMM hanya mendukung jaringan Solana (SOL).

Mengapa nilai posisi saya ditampilkan dalam token LP dan bukan jenis koin yang di-stake?

Ketika Anda menyediakan likuiditas, deposit awal koin tertentu Anda (misalnya, SOL dan USDC) akan dikonversi menjadi representasi bagian Anda dalam pool likuiditas — umumnya disebut token LP atau posisi LP Anda.

Posisi ini merefleksikan total nilai kontribusi Anda dalam pool, yang berfluktuasi seiring waktu berdasarkan biaya trading dan kerugian atau keuntungan tidak permanen. Platform menampilkan nilai posisi Anda dalam token LP karena merepresentasikan bagian proporsional dari aset pool, bukan koin individual yang Anda depositkan.

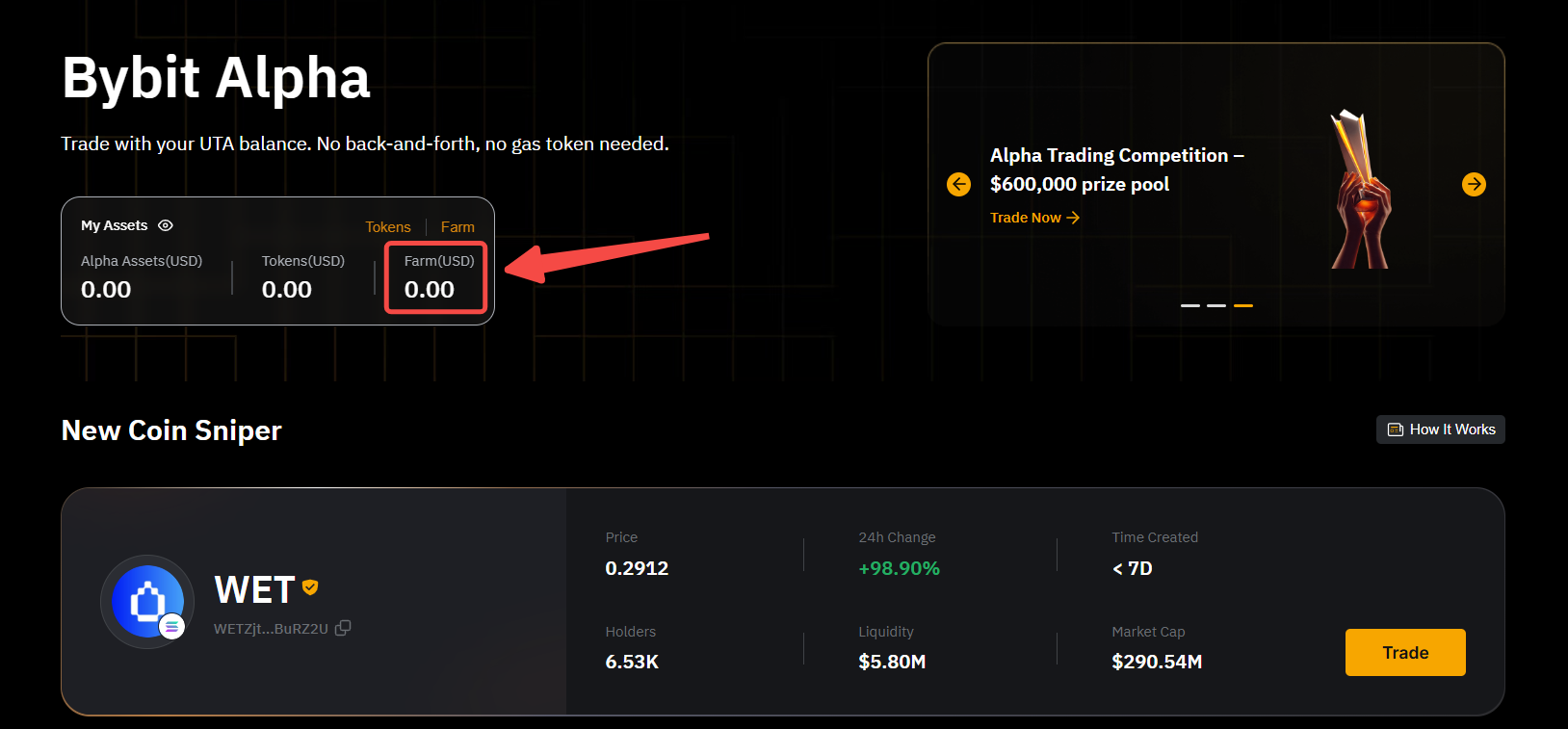

Di mana saya dapat menemukan total nilai posisi likuiditas saya?

Anda dapat melihat total nilai posisi likuiditas Anda dalam Farm (USD) di bagian Aset Saya di halaman Bybit Alpha Bybit.

Jika Anda menggunakan Aplikasi Bybit, buka beranda Bybit Alpha → Aset → Farm.

Mengapa saya tidak menerima hasil setelah menarik likuiditas saya?

Ini mungkin karena Anda hanya menarik sebagian likuiditas Anda. Untuk membantu mengurangi biaya transaksi on-chain, hasil hanya didistribusikan setelah Anda menarik semua likuiditas Anda.

Mengapa saya berinvestasi di SOL-USDC tetapi menerima jenis token lain sebagai hadiah?

Dengan menyediakan likuiditas ke pool SOL-USDC, Anda dapat mendapatkan penghasilan dari biaya tradingyang dibayarkan dalam SOL atau USDC. Selain itu, protokol terkadang dapat mendistribusikan token insentif, seperti RAY, sebagai hadiah ekstra.

Apa saja kemungkinan penyebab kegagalan staking dan bagaimana cara memperbaikinya?

Dari mana imbal hasil berasal?

Pendapatan LP berasal dari dua sumber utama:

- Biaya trading yang dihasilkan di pool.

- Hadiah token insentif khusus untuk pool tersebut.

Bagaimana hadiah dan APR dihitung?

APR dihitung berdasarkan rentang harga yang Anda pilih dan biaya trading yang dihasilkan dalam rentang tersebut selama periode tertentu, dikalikan dengan bagian Anda dalam pool likuiditas. Perkiraan APR yang ditampilkan hanya untuk referensi — imbal hasil aktual Anda akan bergantung pada jumlah pada saat Anda menarik likuiditas.

Dapatkah saya menebus likuiditas saya kapan saja?

Ya, Anda dapat menambahkan atau menarik likuiditas kapan saja.

Saya mencoba menebus 8% likuiditas saya, tetapi opsi Tarik Likuiditas tidak tersedia. Mengapa?

Hal ini dapat terjadi jika jumlah yang Anda tebus tidak cukup untuk menutupi biaya layanan dan jaringan yang diperlukan. Silakan mencoba meningkatkan jumlah penebusan Anda.

Apa saja kemungkinan penyebab kegagalan penebusan dan bagaimana cara memperbaikinya?

Mengapa saya perlu membayar biaya staking dan penebusan, dan jenis biaya apa yang dikenakan?

- Biaya layanan: Ketika Anda menambahkan atau menarik likuiditas, biaya layanan dikenakan untuk swap token dan untuk menambahkan atau menarik token dari pool likuiditas.

- Biaya jaringan: Biaya jaringan berlaku untuk memproses transaksi on-chain.

Anda dapat memeriksa biaya pastinya saat menempatkan pesanan.

Apakah jumlah investasi termasuk biaya?

Tidak, jumlah investasi tidak termasuk biaya.

Apakah ada kalkulator untuk perkiraan penghasilan?

Anda dapat memeriksa perkiraan APR atau hasil harian sebelum membuat pesanan.