Pesanan One-Cancels-the-Other (OCO) menawarkan alat yang mutakhir kepada trader untuk eksekusi bersamaan berbagai jenis pesanan, meningkatkan manajemen risiko, dan otomatisasi perdagangan. Fungsi ini memasangkan dua (2) pesanan bersyarat, dengan pembatalan otomatis satu (1) pesanan akan memicu pengeksekusian pesanan lainnya. Pesanan OCO dirancang untuk meningkatkan efisiensi perdagangan dan kontrol risiko, yang menawarkan keunggulan kompetitif di pasar.

Keuntungan Utama dan Pembatasan

Pesanan Bersyarat Bersamaan: Trader dapat secara bersamaan mengatur pasar bersyarat atau pesanan stop rugi bersyarat untuk satu aset. Misalnya, Anda dapat menempatkan kerugian stop pasar bersyarat dan pesanan take profit terbatas bersyarat untuk aset yang sama. Persyaratan margin dihitung berdasarkan jumlah aset yang sama.

Mekanisme Pembatalan: Dalam pesanan OCO, eksekusi satu pesanan memicu pembatalan otomatis pesanan yang sesuai. Trader yang menempatkan pesanan terbatas bersyarat harus memperhatikan bahwa pesanan mereka dapat memicu tetapi tidak mengeksekusi, yang menyebabkan pembatalan pesanan terkait selanjutnya.

Tidak Tersedia untuk Penggunaan API: Pengguna API tidak akan memiliki akses ke pesanan OCO, karena mereka dapat merancang strategi untuk mereplikasi fungsi serupa.

Khusus untuk Trader Margin Spot dan Spot: Pesanan OCO hanya tersedia untuk pengguna yang terlibat dalam perdagangan Margin Spot atau Spot.

Baca Selengkapnya

Pesanan OCO: Bagaimana Mereka Dapat Membatasi Risiko Perdagangan Kripto Anda

Bagaimana Cara Kerja Pesanan OCO?

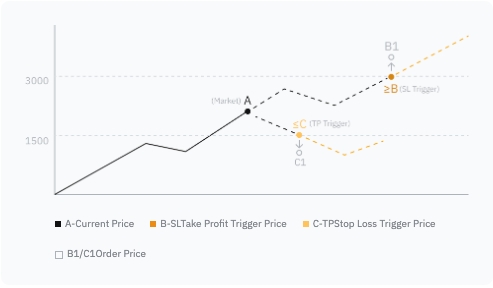

Pesanan OCO Bybit diatur dengan dua (2) pemicu arah: satu untuk batas atas dan satu untuk batas bawah relatif terhadap harga perdagangan saat ini. Ketika satu arah dipicu, arah lain secara otomatis dibatalkan, dan pasar atau pesanan terbatas yang ditetapkan pada arah yang dipicu mulai berlaku. Ketika pesanan OCO ditempatkan, hanya biaya pesanan satu sisi yang akan digunakan.

|

Pesanan Beli OCO |

Pesanan Jual OCO |

|

Harga pemicu (C) untuk pesanan Beli pada batas bawah (Take Profit) harus di bawah harga pasar saat ini, sedangkan harga pemicu (B) untuk pesanan Beli pada batas atas (Stop Loss) harus di atas harga pasar saat ini. |

Harga pemicu (C) untuk pesanan Jual pada batas bawah (Stop Loss) harus di bawah harga pasar saat ini, sedangkan harga pemicu (B) untuk pesanan Jual pada batas atas (Take Profit) harus di atas harga pasar saat ini. |

|

|

|

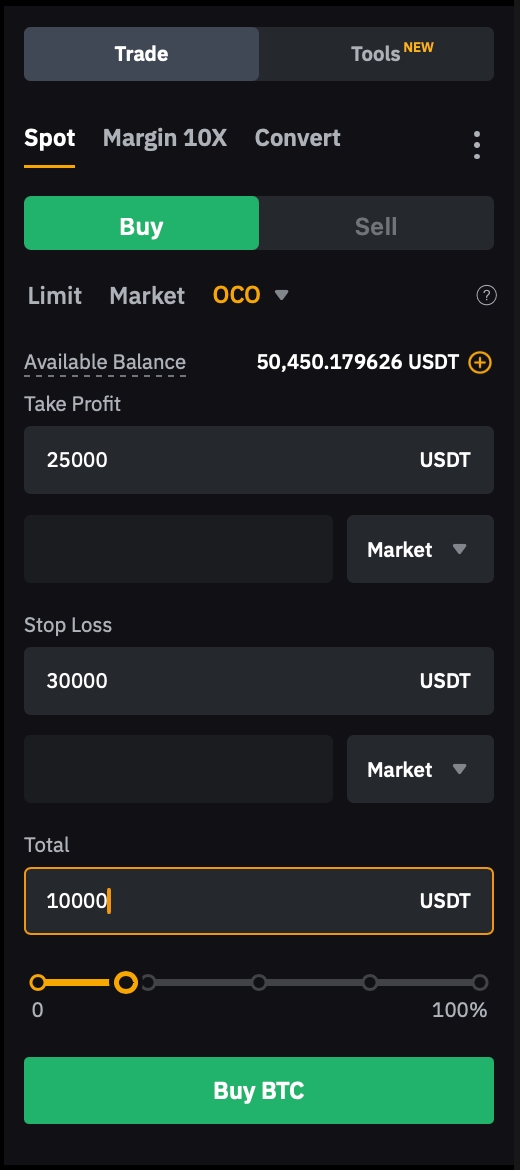

Contoh 1 (Strategi entri)

Misalkan, BTC diperdagangkan dalam rentang $25.000 dan tingkat resistensinya sebesar $30.000. Trader A berniat untuk membeli BTC jika harga melambung hingga $25.000 atau melampaui resistansi $30.000.

Dengan asumsi harga saat ini adalah $27.000, Trader A telah menyiapkan pesanan OCO untuk mengeksekusi perdagangan atas terobosan resistensi atau retracement dukungan, dengan pengaturan sebagai berikut:

-

Menetapkan harga batas bawah menggunakan pesanan pasar bersyarat (Take Profit) dengan harga pemicu ditetapkan pada $25.000.

-

Menetapkan harga batas atas menggunakan pesanan pasar bersyarat (Stop Loss) dengan harga pemicu ditetapkan pada $30.000.

Skenario Hasil:

Skenario 1 (Pullback terjadi):

Harga BTC turun menjadi $25.000. Pesanan take profit Trader A dipicu dan dipenuhi pada harga pasar. Pesanan chasing Trader A senilai $30.000 telah dibatalkan secara otomatis sejak pullback terjadi.

Skenario 2 (Tidak ada pullback, kenaikan langsung):

Harga BTC naik tanpa meraup kembali $25.000.

Jika harga terus naik dan mencapai $30.000, pesanan chasing Trader A dipicu dan dipenuhi pada harga pasar, dan pesanan take profit terkait sebesar $25.000 akan dibatalkan.

Dalam hal ini, Trader A telah siap untuk melakukan pullback dan mengejar peluang. Pesanan senilai $25.000 berfokus pada potensi retracement, sedangkan pesanan senilai $30.000 menargetkan kemungkinan breakout. Tergantung pada pergerakan pasar, strategi Trader A memungkinkannya untuk memanfaatkan berbagai skenario.

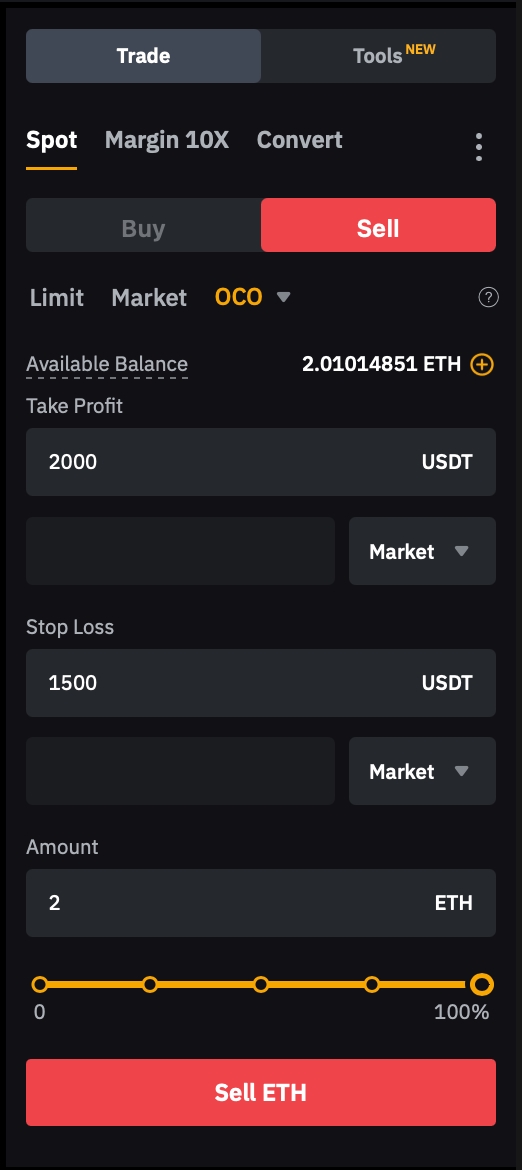

Contoh 2 (Strategi exit)

Misalkan Trader B memiliki 2 ETH dengan harga beli rata-rata $1.500. Dia mengantisipasi kenaikan harga ETH dalam waktu dekat menjadi $2.000 sekaligus juga bertujuan untuk mencapai titik impas jika terjadi penurunan pasar.

Dengan asumsi harga saat ini adalah $1.700, Trader B membuat pesanan jual OCO sebagai strategi take profit dan stop loss-nya, dengan pengaturan sebagai berikut:

-

Menetapkan harga batas atas menggunakan pesanan pasar bersyarat (Take Profit) dengan harga pemicu ditetapkan pada $2.000.

-

Menetapkan harga batas bawah menggunakan pesanan pasar bersyarat (Stop Loss) dengan harga pemicu ditetapkan pada $1.500.

Skenario Hasil:

Skenario 1 (Ambil Untung):

Jika harga ETH naik menjadi $2.000, pesanan Take Profit Trader B terpicu, dan ETH-nya dijual pada harga pasar. Pesanan Stop Loss yang sesuai pada $1.500 dibatalkan secara otomatis karena take profit tercapai.

Skenario 2 (Stop Rugi):

Jika terjadi penurunan pasar, di mana harga ETH turun menjadi $1.500, pesanan Stop Loss Trader B dipicu, yang menyebabkan penjualan ETH-nya pada harga pasar. Pesanan Take Profit yang sesuai akan dibatalkan.

Dalam hal ini, Trader B telah menyiapkan pesanan Take Profit untuk mengamankan potensi keuntungan di pasar naik dan pesanan Stop Loss untuk mitigasi risiko.

Catatan:

— Saat ini, TP/SL dengan pasar bersyarat atau pesanan terbatas bersyarat didukung. Untuk pesanan pasar bersyarat, hanya diperlukan harga pemicu. Namun, untuk pesanan terbatas bersyarat, pengguna harus menetapkan harga pemicu dan harga pesanan.

— Pesanan terbatas memberikan kendali yang lebih tepat atas harga eksekusi. Namun, ada kemungkinan pesanan terbatas Anda mungkin tidak akan dieksekusi jika pasar tidak mencapai harga yang Anda tentukan. Untuk mendapatkan informasi selengkapnya, silakan lihat di sini.

— Untuk OCO TP/SL dengan pesanan terbatas bersyarat, harap diperhatikan bahwa ketika salah satu pesanan terbatas bersyarat dipicu, pesanan SL atau TP yang sesuai akan dibatalkan, meskipun pesanan batas tidak terpenuhi. Hal ini karena sistem memperlakukan satu set pesanan OCO TP/SL secara keseluruhan. Selama harga pemicu satu pesanan tercapai, kondisi pemicu dianggap terpenuhi, dan pesanan yang sesuai akan dibatalkan.

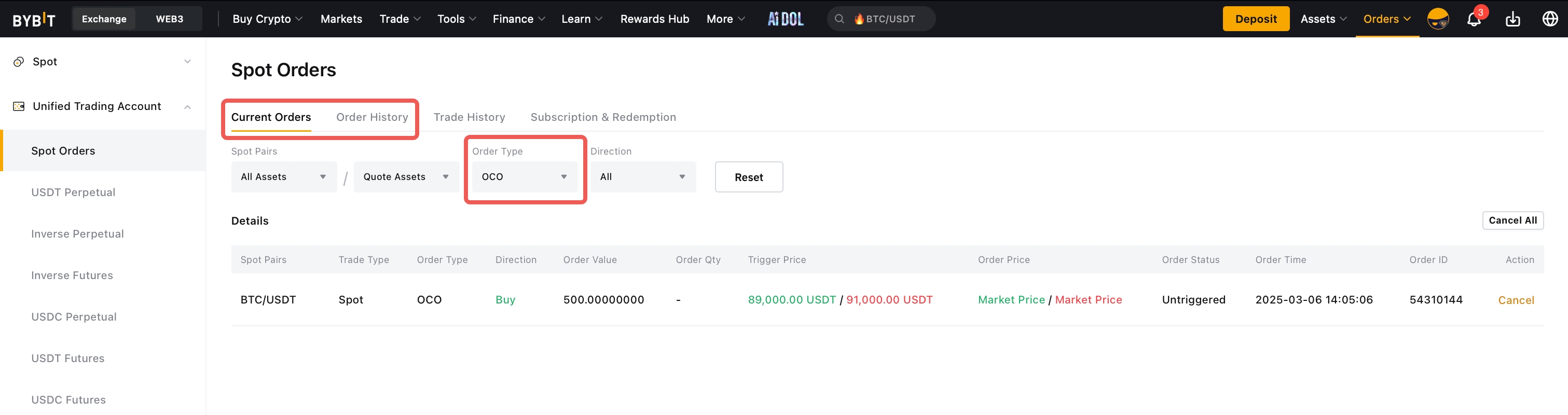

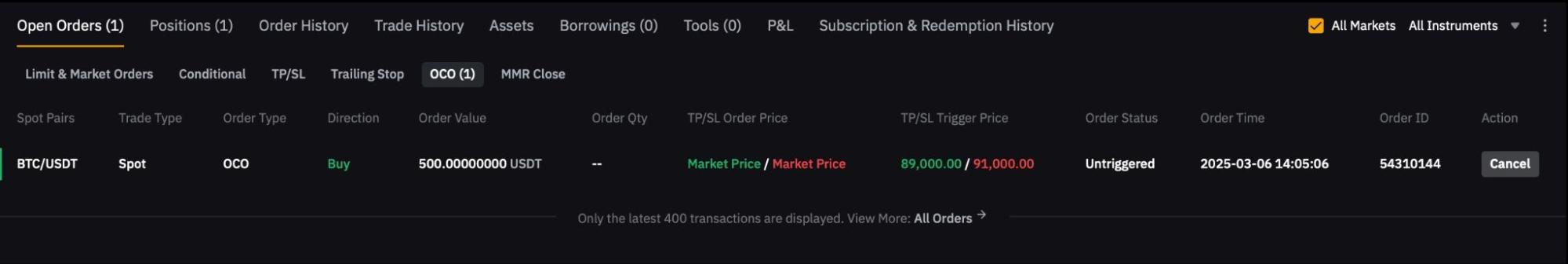

Lihat Detail dan Riwayat Pesanan OCO Anda

Anda dapat melihat pesanan OCO tertunda Anda dengan menavigasi ke tab Pesanan Terbuka dan memeriksa pesanan OCO yang dieksekusi atau dibatalkan di bawah tab Riwayat Pesanan.

Atau, silakan membuka laman Pesanan Akun Perdagangan Terpadu Anda → Pesanan Spot → Pesanan Saat Ini atau laman Riwayat Pesanan.