What is the Goods and Services Tax (GST) in India?

The Goods and Services Tax (GST) is a consumption-based tax levied on the supply of goods and services in India. Under Indian tax regulations, an 18% GST applies to any service or trading fees charged by crypto exchanges.

This means that, in addition to standard service fees and trading fees, Bybit users in India must also pay an additional 18% GST. However, this tax doesn't apply to fee-free services.

What is Tax Deducted at Source (TDS) in India?

Tax Deducted at Source (TDS) is a 1% tax applied to payments made for the transfer of Virtual Digital Assets (VDAs), including cryptocurrencies.

For Indian users, TDS applies in the following cases:

- Crypto to fiat: When an Indian resident sells crypto for fiat. (TDS does not apply when buying crypto with fiat.)

- Crypto to crypto: When an Indian resident trades one cryptocurrency for another.

The TDS amount is deducted directly from the assets received during the transaction.

Who is subject to GST and TDS in India?

GST and TDS apply to any user whose verified identity, proof of address or declared address indicates a location in India. This includes cases where any part of the Identity Verification details or declared address shows India as the user's location.

My country/region of residence has changed. How can I update my Identity Verification information?

Currently, proof of address updates are not supported for Indian users. Our self-service update feature will be available soon, and you will be able to update by then.

What products and services are subject to GST?

An 18% GST will be applied on top of the trading or service fees for the following products.

Disclaimer:

Please note that this is only a general overview of scenarios where GST may be charged. As Bybit's product offerings are subject to ongoing updates, Bybit reserves the right to apply GST to applicable scenarios that may not be explicitly listed here.

What products and services are subject to TDS?

Disclaimer:

Please note that this is only a general overview of scenarios where TDS may apply. As Bybit's product offerings are subject to ongoing updates, Bybit reserves the right to apply TDS to applicable scenarios that may not be explicitly listed here.

Are there any other products or services impacted?

In line with Indian regulations and Bybit's business strategy, we've made some adjustments. The following products and services will be unavailable to users in India: Bybit Card, Trading Bot, Legacy Crypto Loan, TradFi, and P2P Trading in altcoins (BTC, ETH, USDT and USDC are not affected). We appreciate your understanding and continued support.

Where can I find the GST and TDS information?

Before confirming your order, you can view the amount you'll pay and receive, along with the applicable GST and TDS.

After the order is filled, you can find the details from:

- The Trade History section at the bottom of the trading page.

- The Trade History tab on the Orders page.

Where can I download my GST and TDS invoices?

You can download your GST and TDS invoices from the Bybit website by following these steps:

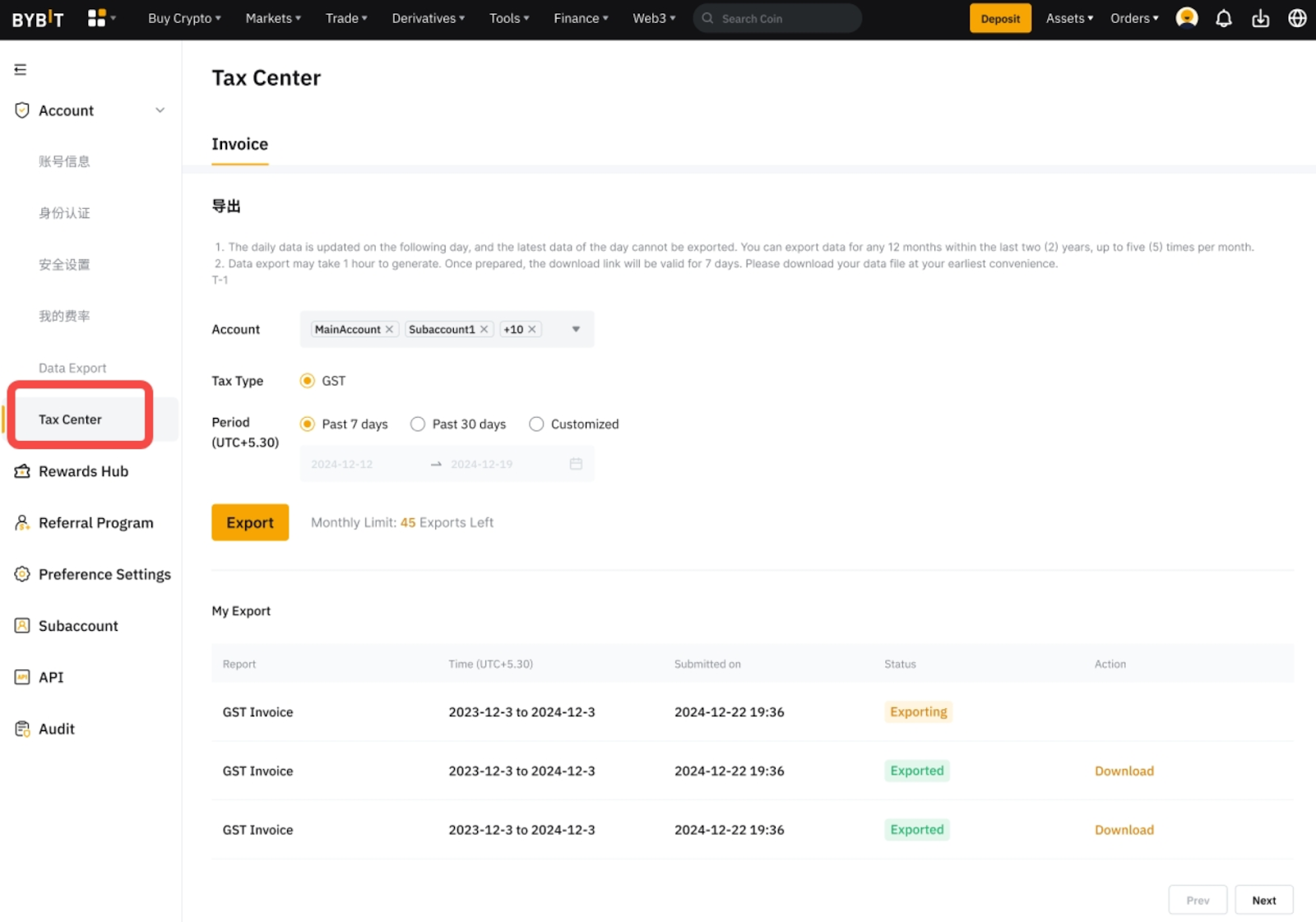

Step 1: Hover over your profile icon in the navigation bar and go to Account → Tax center in the left panel.

Step 2: Set your parameters:

- Account: Choose your Main Account and/or Subaccount.

- Tax type: Currently, GST and TDS are supported.

- Period: Select from the past 7 or 30 days, or customize a range of up to 31 days.

Note: The earliest available start date is the date when GST was implemented on our platform, and the latest possible date is the previous day (T-1). Please note that the selected time range follows the India time zone (UTC+05:30).

Step 3: Click Export to download your invoice as a PDF file.